Portfolio allocation calculator

The simplest definition of a portfolio is a. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

The Best Free Asset Allocation Spreadsheet Valuist

For example if youre 30 you should keep.

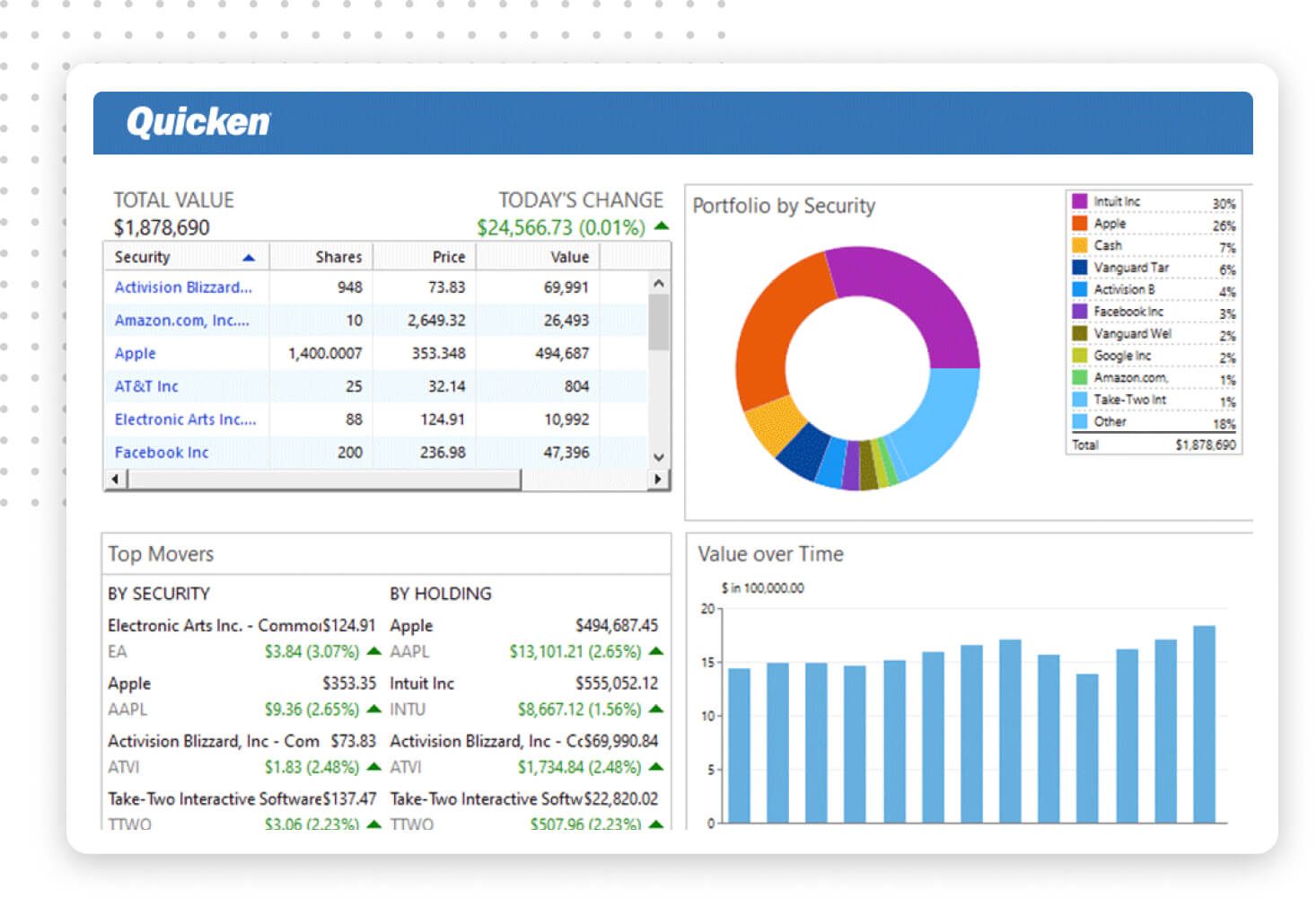

. A portfolio is one of the most basic concepts in investing and finance. You can analyze and backtest portfolio returns risk characteristics style exposures and drawdowns. Connect your exchanges and wallets.

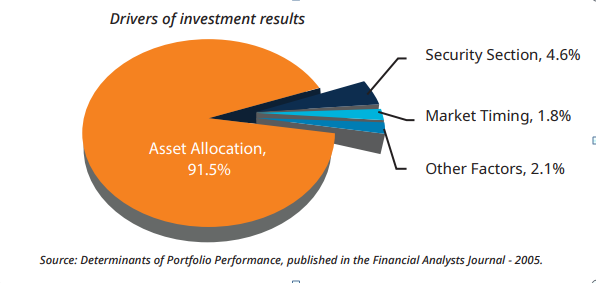

Identifying stocks is the first thing but allocation will make a huge lot of difference in generating returns. Because we see your complete financial picture we can provide an efficient allocation. Click here to track and Analyse your mutual fund investments Stock Portfolios Asset Allocation.

For instance say you started with an asset allocation that targets 60 stock and 40 bonds but 70 of your portfolio consists of stocks. Under a strategic asset allocation approach even if stocks are performing well at present you should sell the excess 10 in stocks in order to bring your stock allocation back down to the target of 60. The portfolio manager would handle those funds and change asset allocation accordingly.

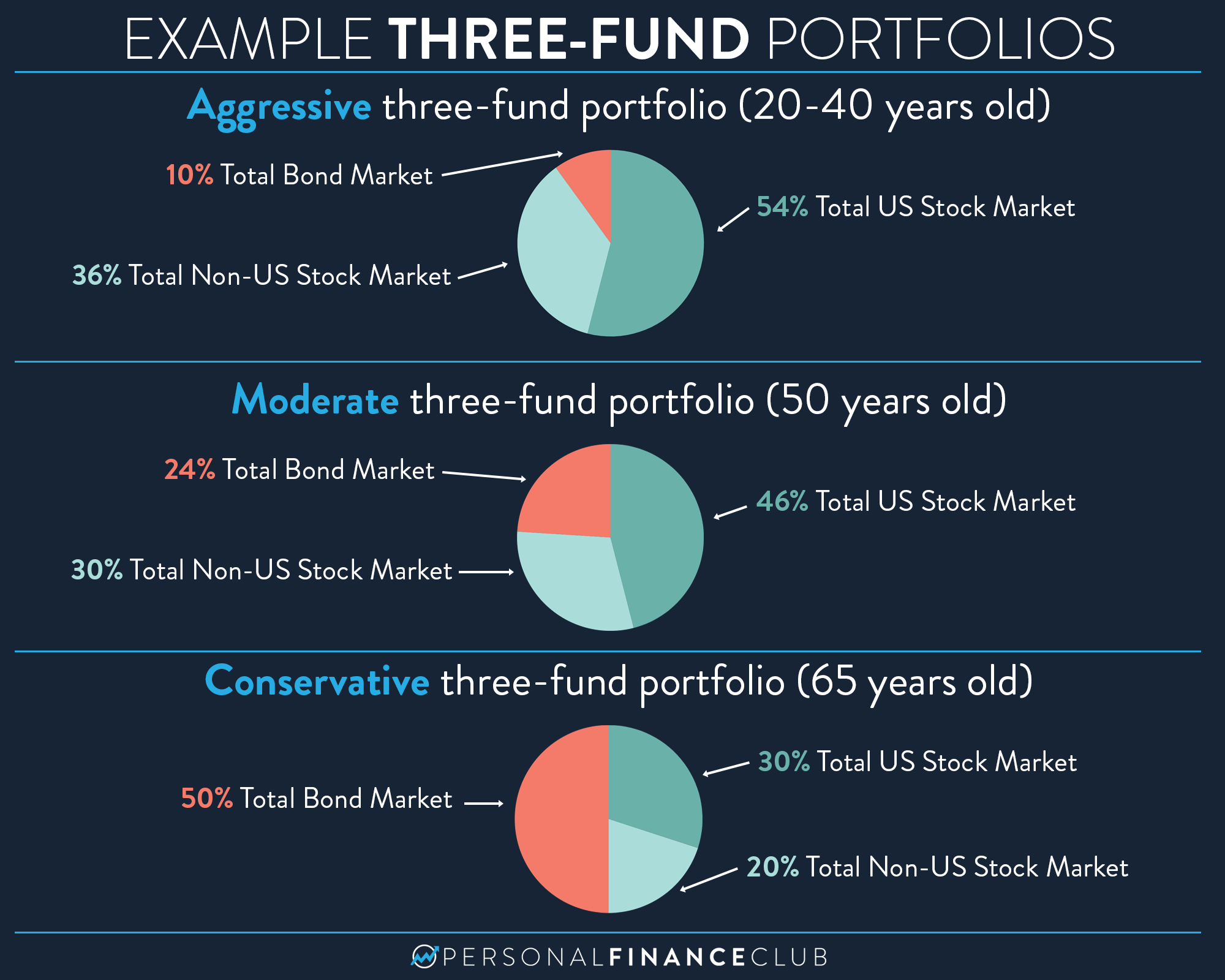

Asset Allocation Mutual Funds Target Date Mutual Funds. This Asset Allocation provided herein is purely derived out of mathematical calculations for illustrative purpose only and developed considering various risk tolerance level asset classes and product offered by Quantum Mutual Fund on a. Start tracking your investments in stocks mutual fund gold bank deposits property and get all.

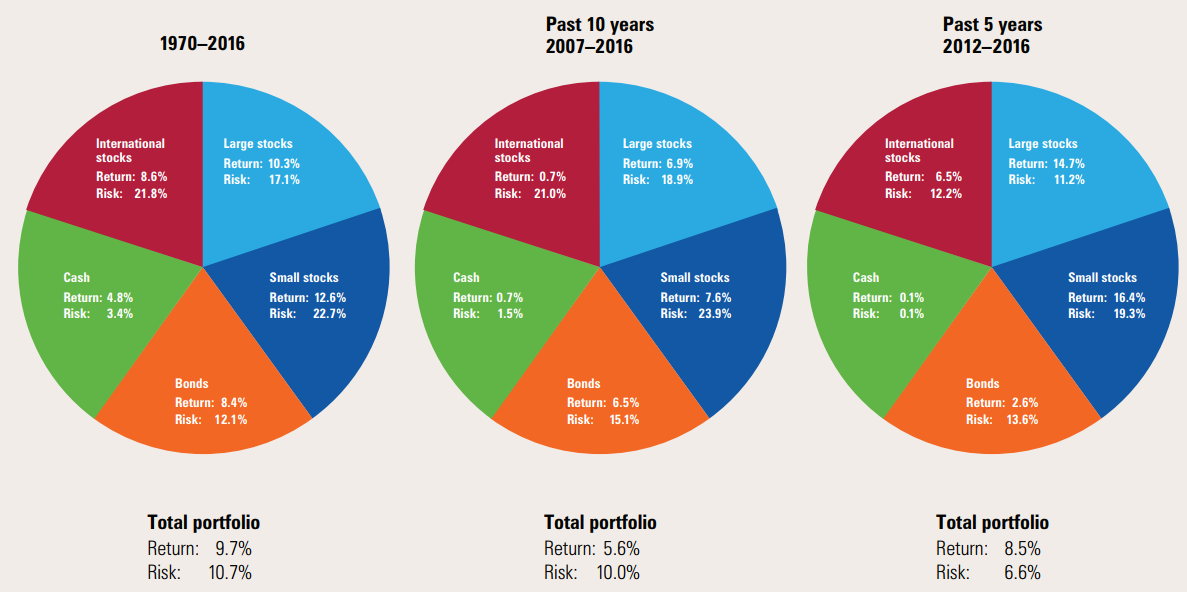

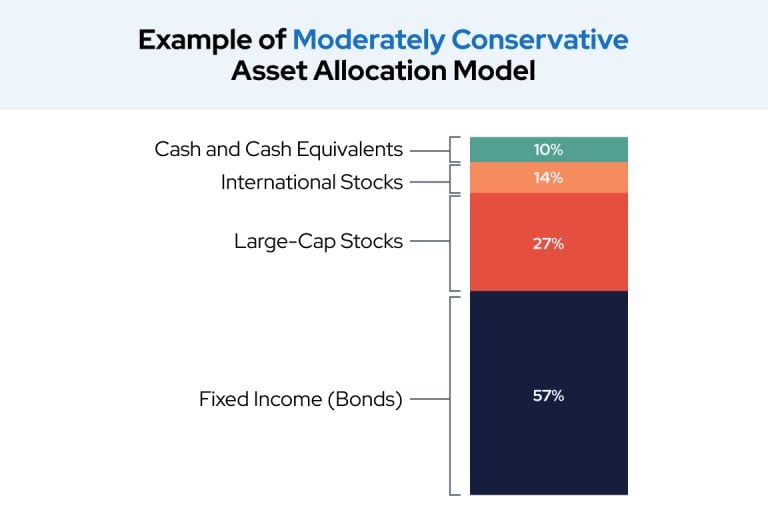

You can compare up to three different portfolios against the. Backtest Portfolio Asset Allocation. An asset allocation strategy with a well-diversified portfolio is the key to managing risk and ensuring low deviation from the expected outcome.

You can get latest FD rates for SBI HDFC Bank ICICI Bank Axis Bank Kotak Mahindra Bank Bank of Baroda Punjab. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Resource allocation decisions play a dominant role in shaping a firms technological trajectory and competitive advantage.

This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds ETFs and stocks. Click here to track and Analyse your mutual fund investments Stock Portfolios Asset Allocation. All you need to do is.

Our research shows that regular rebalancing can significantly enhance portfolio value over time. How should I allocate my assets. Our allocation strategy is more inclined toward taking concentrated bets comprising 15- 20 stocks.

Create an account with ZenLedger. Diversify your Mutual Fund Investment Portfolio across asset classes with our tried and tested 12. Get it for yourselfA project that Ive always had was to improve on my stock portfolio tracking spreadsheetsDuring this time Ive probably used 10 or so different portfolio trackers but nothing met my needs.

They have an Investment Policy Statement commonly called IPS which shall have a predetermined rate of return Rate Of Return Rate of Return ROR refers to the expected return on investment gain or loss it is expressed as a percentage. Recent work indicates that innovative firms and scientific institutions tend to exhibit an anti-novelty bias when evaluating new projects and ideas. At first glance many investors assume that the basic asset allocation decision is an easy one.

Toggle to portfolio tab. Yields are Up but Fed Policy Poses a Risk. This lets us find the most appropriate writer for any type of assignment.

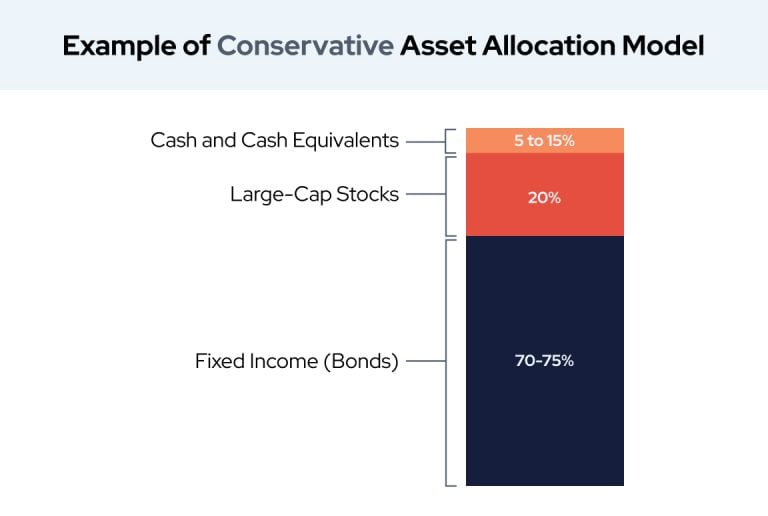

Discover the best asset allocation models to maximize your investment portfolios returns while working within your risk appetite. The portfolios were distributed five days after the state government comprising Shinde-led Shiv Sena faction and the Bharatiya Janata Party BJP inducted 18 ministers during the first cabinet. Get latest fixed deposit rates for all public and private sector banks in India.

This tool will suggest an asset allocation for you across different asset classes based on your level of risk capacity and risk tolerance. I dont do complicated transactions but still nothing could really satisfy meBut. After all at this level you are focusing on only two choicesstocks and bonds.

Each blue line represents the individual portfolio-depleting withdrawal rates for a single retirement start date and shorter lines are from start dates less than 40 years ago. Its a term that can have a variety of meanings depending on context. Bonds can play an important role in your portfolio but how do rising interest rates affect fixed income.

The free crypto portfolio tracker lets you analyze your current portfolio performance and holdings view detailed coin and exchange allocation insights and even monitor real-time coin pricing charts and trends. This portfolio backtesting tool allows you to construct one or more portfolios based on the selected asset class level allocations in order to analyze and backtest portfolio returns risk characteristics drawdowns and rolling returns. Start tracking your investments in stocks mutual fund gold bank deposits property and get all.

In this paper we focus on shedding light into this observed pattern by. The orange line tracks the worst-case withdrawal rates also called the Safe Withdrawal Rate of the entire dataset and for start dates less than 40 years ago it also projects future withdrawal rates. Vanguard offers data on the historical risk and return of various portfolio allocation models based on data from 1926 to 2018.

Get 247 customer support help when you place a homework help service order with us. Our strategy is to divide the portfolio into three pies- high growth companies emerging giants and cyclical companies to create alpha. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

Investors must understand the overall risk associated with the asset allocation strategy. The results cover both returns and fund fundamentals based portfolio style. Buy Car Calculator.

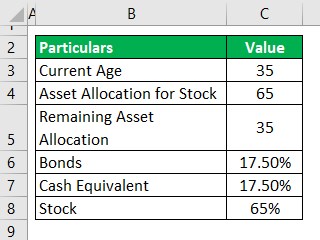

A stock portfolio tracker using Google Drive with advanced functions than your average tracker. Age ability to tolerate risk and several other factors are used to calculate a desirable mix of. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks.

Everyones risk-taking capabilities differs and there are various ways to measure your risk tolerance. Backtest Portfolio Asset Class Allocation. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator.

For example a portfolio consisting of 100. As your life evolves we will recommend allocation adjustments to keep the strategy current with your ever changing situation.

The Proper Asset Allocation Of Stocks And Bonds By Age

How To Maintain Proper Asset Allocation With Multiple Investing Accounts

What Is Asset Allocation How Is It Important In Investing

The Problem With Risk Parity Seeking Alpha

How To Maintain Proper Asset Allocation With Multiple Investing Accounts

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

How To Achieve Optimal Asset Allocation

Asset Allocation The Ultimate Guide For 2021

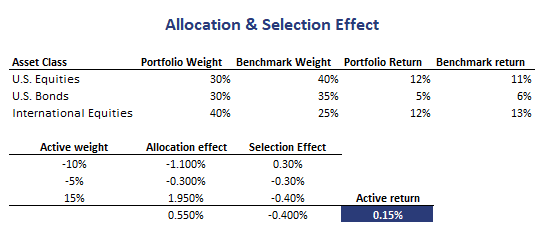

Allocation Effect Implementation In Excel

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

What Is Asset Allocation How Is It Important In Investing

Asset Allocation The Ultimate Guide For 2021

Quicken Product Highlights November 2021

Asset Allocation Importance In Portfolio Management Mirae Asset

The Best Free Asset Allocation Spreadsheet Valuist

Quicken Investing Management Software Track Your Investments Today

Three Fund Portfolio Personal Finance Club

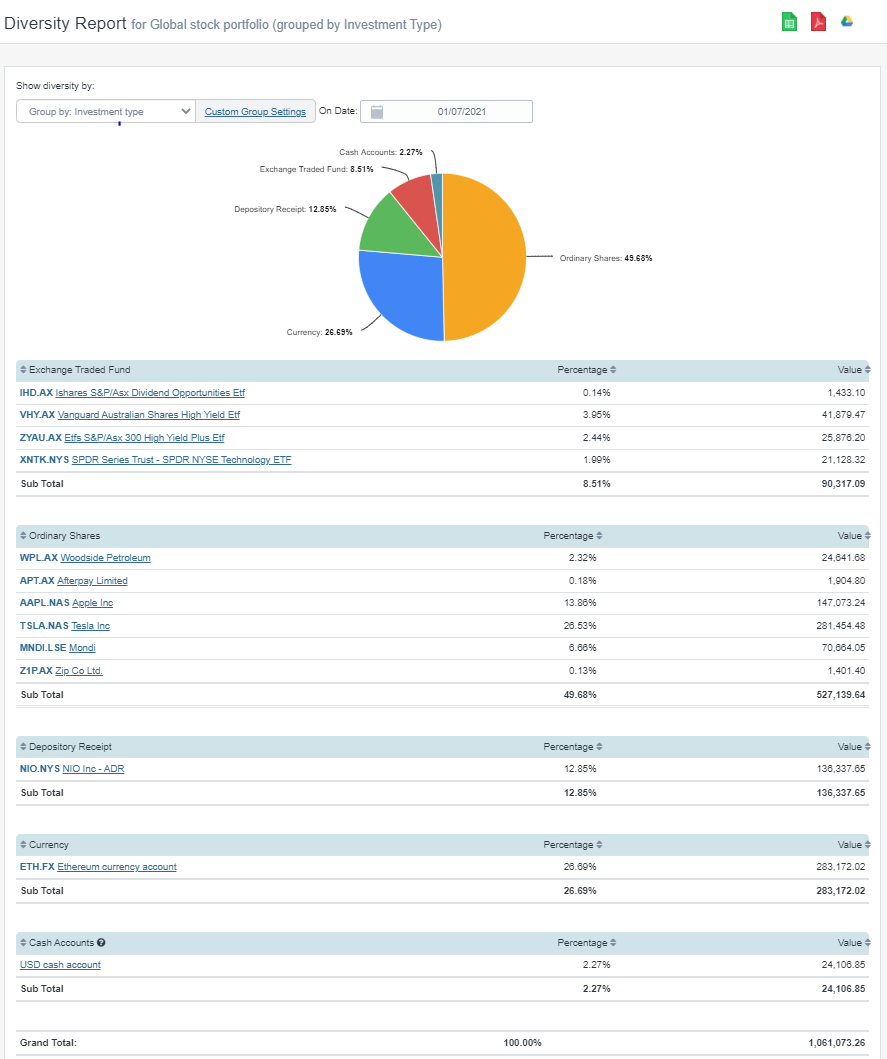

Calculate Your Investment Portfolio Diversification With Sharesight